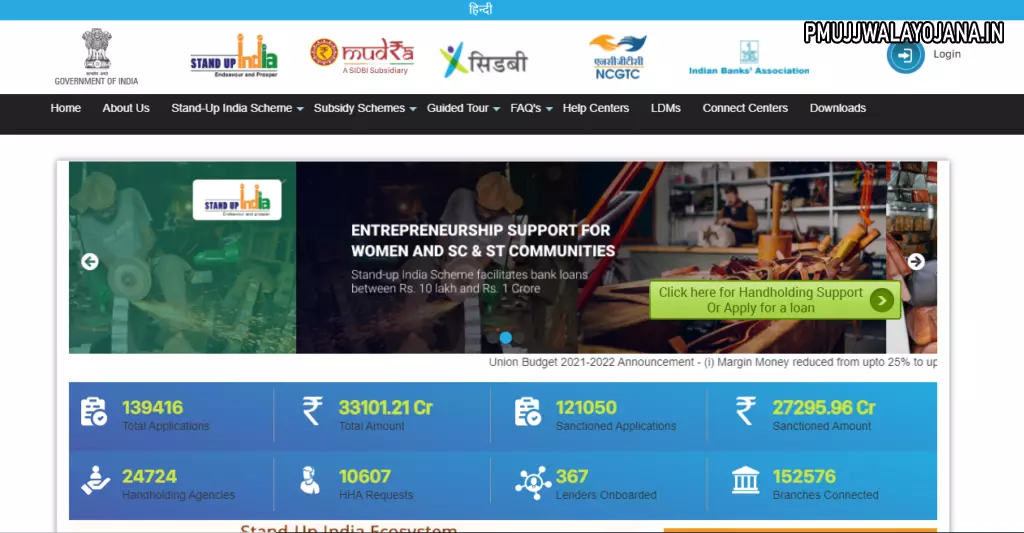

Stand Up India Loan Scheme – In order to promote entrepreneurship among women in, SC, and ST sectors the Honorable Prime Minister of India Mr. Narendra Modi has launched the Stand Up India Loan Scheme. This scheme was launched on 15 August 2015 in order to make beneficiaries economically empowered. Other than that this scheme also helps in creating job opportunities. This scheme enables the beneficiary to participate in the economic growth of the nation. Nearly 2.5 lakh beneficiaries through 1.25 lakh banks will be benefited from this scheme. Through this article, we are going to provide you with complete details regarding this scheme its objective, benefits, features, eligibility criteria, required documents, apply online, log in, track application status, etc.

Stand Up India Loan Scheme 2024

This scheme has been launched in order to facilitate SC/ST and women entrepreneurs in setting up enterprises, obtaining loans, and providing other support which is needed from time to time. Under this scheme, all the branches of scheduled commercial banks will be covered directly at the branch or through SIDBI stand-up India portal through the lead district manager.

The Government of India has launched a Stand Up India Loan Scheme. Under this scheme, bank loans are provided to scheduled castes, scheduled tribes, and women borrowers. These bank loans will range from Rs 10 lakh to Rs 1 crore. With the help of this scheme, at least one scheduled caste or scheduled tribe borrower and at least one woman borrower per bank branch will be provided a loan for setting up a Greenfield Enterprise. This enterprise can be a manufacturing, service, Agri allied activity, or trading sector. If the enterprise is nonindividual then at least 51% of the shareholding and controlling stake is required to be held by SC/ST or women entrepreneurs.

Stand Up India Loan Scheme Details

| Name Of The Scheme | Stand Up India Loan Scheme |

| Launched By | Government Of India |

| Beneficiary | Citizens Of India |

| Objective | To Provide Financial Support For Setting Up Enterprise |

| Official Website | https://www.standupmitra.in/ |

| Year | 2024 |

| Launched On | 15th August 2015 |

| Mode Of Application | Online |

Objective Of Stand Up India Loan Scheme

The main objective of the Standup India loan scheme is to provide financial support for setting up Greenfield Enterprise. Through this scheme financial support from Rs, 10 lakh to Rs 1 crore is provided to SC, ST or women entrepreneurs. With the help of this scheme SC, ST, and women entrepreneurs will be facilitated in setting up enterprises, obtaining loans, and getting other support that is needed from time to time. Other than that through this scheme employment will be generated which will reduce the unemployment rate. Nearly 2.5 lakh beneficiaries will be benefited through 1.25 lakh banks under the stand-up India loan scheme.

Stand Up India Loan Scheme Portal

- In order to get the benefit of this scheme beneficiaries are required to register through the official portal

- Through this portal, feedback information will be provided

- This portal can be accessed at home, at the common service center, through a Bank branch and through LDM

- If any bank branch internet access is restricted then the branch will guide the potential borrowers to an internet access point

- This portal will host Information about various entities which are providing handholding support to the borrower which includes training, DPR preparation, margin money support, shed/workplace identification, raw material sourcing, bill discounting, e-Com registration, registration for taxation

- Through the portal application forms can be obtained gathered and provided information

Types Of Borrowers Under Stand Up India Loan Scheme

- Ready borrower- If the borrower does not require any handholding support then that borrower will be considered a ready borrower. This borrower can start the process of applying for a loan at the selected Bank. After the application, the borrower will get the application number, and the information about the borrower will be shared with the bank LDM and the relevant NABARD and SIDBI link office. After that loan application will be generated and tracked through the portal

- Trainee borrower- If the borrower requires handholding support, that borrower will be considered a trainee borrower. NABARDand SIDBI will arrange for support for the trainee borrower through financial training, skilling, margin money mentoring, support utility, connection, etc. Other than that the LDM will also monitor the process of work with the local offices of SIDBI and NABARD in order to solve problems and ease bottlenecks. After adequately meeting the hand-holding requirements and attaining the satisfaction of LDM and the trainee borrower the loan application will be generated through the portal.

Stand Up India Loan Scheme Margin Money And Grievance Redressal

- Under the scheme, 15% margin money will be envisaged

- The borrower is required to invest at least 10% of the project cost as their own contribution

- If the state scheme supports the borrower with 20% of the support cost as subsidies then the borrower is required to contribute at least 10% of the project cost

- The district-level credit committee will be responsible for implementing this scheme

- Various kinds of events will be organized at the district level which involve stakeholders of the scheme in order to guide potential entrepreneurs

- This event will guide the entrepreneurs in making registrations

- SIDBI will provide support for the organization of these events

- The grievances of the borrower will also be addressed

- The portal provides contact details of various officers who will attend to the grievances

- Soon an online process for the submission of complaints and subsequent tracking through the portal will be developed

- Other than that feedback on the disposal of complaints will be made available by the customers

Responsibilities Of Stakeholders Under Stand Up India Loan Scheme

Borrowers

- Borrowers are required to make payments in due time

- If the borrowers are categorised trainee borrower then they are required to go through the sequence of hand holding support as applicable

- The borrowers are required to access the portal or visit the bank branch and answer some questions

- Submit all the required documents

- Attend all the quarterly events on experience sharing, best practices etc

- Setup and run the enterprise efficiently

Bank branches

- Monitor the performance of scheme

- Redress grievance at Bank level within 15 days

- Help potential borrowers in accessing the portal

- Process all the applications which are received online or in person

- Process loan within the stipulated time frame

- If the loan is rejected then the reason for rejection should be made available and known to the borrower

DLCC

- Address all the grievance at district level

- Resolve issues relating to public utility service and workspace for potential borrowers

- Review progress from time to time

LDMs

- Monitor the progress of the scheme

- Participate in the events organised by NABARD with all the stakeholders

- Conduct district level committee meetings periodically

- Satisfy the borrowers requirement of hand holding to be maximum extent

- Follow up with all the concerned officers

- Provide information to the bankers of the potential borrowers

NABARD

- Organised event as and when required (at least once in each quarter) among the stakeholder for experience sharing

- Assist SLB and DLCC in reviews and monitoring

- Coordinate with LDM

- Liaise with bank to follow up on potential cases

- Arrange handholding support

- Provide training to other stakeholders

SIDBI

- To participate in the events organised by NABARD

- Assist SLBC and DLCC in review and monitoring

- Coordinate with LDM

- Liaise with bank in order to follow for potential cases

- Arrange handholding support

- Operate and maintain the web portal

Statistics

| Total application | 204796 |

| Total amount | 48057.36 crore |

| Sanctioned application | 184267 |

| Sanctioned amount | 41478.77 crore |

| Hand holding agencies | 24613 |

| HHA request | 3294 |

| Lenders onboarded | 82 |

| Branches connected | 137243 |

Benefits And Features Of Stand Up India Loan Scheme

- The Government of India has launched stand up India loan scheme

- Through this scheme bank loans are provided to scheduled caste, scheduled Tribes and women borrowers

- These bank loans will range from Rs 10 lakh Rs 1 crore

- With the help of this scheme at least 1 schedule caste or scheduled tribe borrower and at least one woman borrower per bank branch will be provided a loan for setting up a Greenfield Enterprise

- This enterprise can be a manufacturing, service, agri allied activity or trading sector

- If the enterprise is non individual then at least 51% of the share holding and controlling stake is required to be held by SC /ST or women entrepreneur

- Under the scheme composite loan of 85% of the project cost inclusive of term loan and working capital will be provided

- The rate of interest will be lowest applicable rate of bank for that category not to exceed (base rate (MCLR)+ 3% + tenor premium

- Other than primary security the loan can be secured by collateral security or guarantee of credit guarantee fund scheme for stand up India loan as decided by the bank

- This loan is to be repayable within a period of 7 years with the maximum moratorium period of 18 months

Eligibility Criteria Of Stand Up India Loan Scheme

- Applicant must be permanent resident of India

- The applicant must be SC/ST or women entrepreneur

- Age of the applicant should be above 18 years

- The borrower should not be a defaulter of any Bank or financial institution

- In case of non individual enterprise 51% of the share holding and controlling stake should be held either by SC/ST or women entrepreneur

- Under the scheme loans will be provided only for Greenfield project

Required Documents

- Aadhar card

- Caste certificate

- Application loan form

- Residence certificate

- Age proof

- Passport size photograph

- Mobile number

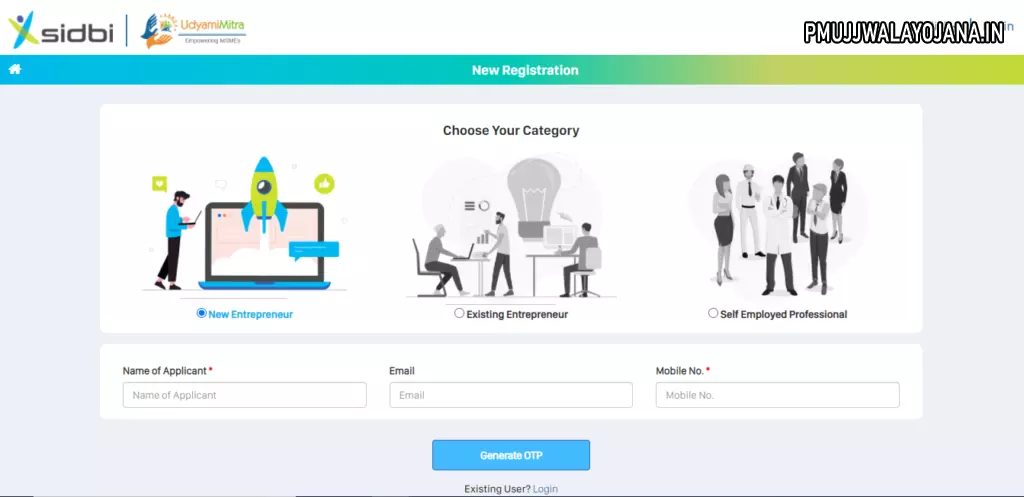

Apply For Loan Under Stand Up India Loan Scheme

- First of all go to the official website of Stand up India loan scheme

- The home page will open before you

- On the homepage click on click here for handholding support or apply for loan option.

- A new page will appear before you

- On this new page you have to choose your category

- After that you have to enter your name email address and mobile number

- Now you have to click on generate OTP

- After that you have to enter OTP into the OTP box

- Now you have to click on register

- After that you after click on login

- Now you have to enter your login credentials and click on login

- Now click on stand up India loan scheme option.

- Application form will appear before you

- You have to enter all the required details in this application form

- Now you have to enter all the required documents

- After that you have to click on submit

- By following this procedure you can apply under stand up India loan scheme

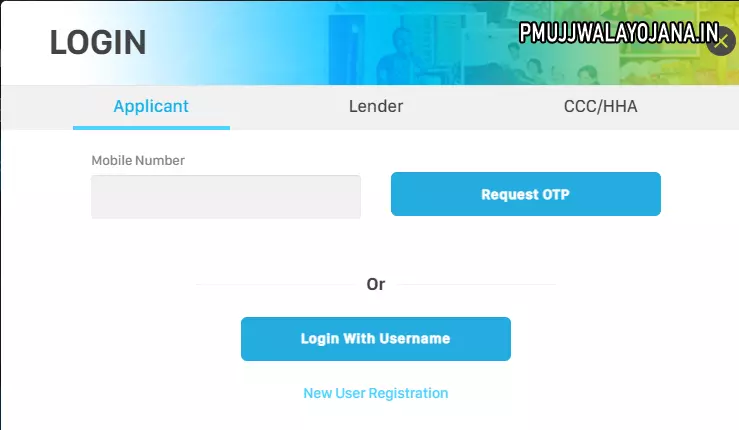

Procedure To Login On The Portal

- Go to the official website of Stand up India loan scheme

- The home page will open before you

- Now you have to click on login

- Following options will appear before you:-

- Applicant

- Other user

- You have to click on the option of your choice

- After that you have to enter username and password

- Now you have to click on login

- By following this procedure you can login on the portal

Track Stand Up India Loan Scheme Application Status

- Go to the official website of Stand up India loan scheme

- The home page will open before you

- Now you should click on track application status

- A new page will appear before you

- On this new page you have to login by entering your login credentials

- Now you have to click on application status

- After that you have to enter your reference number

- Now you have to click on track

- Application status will be on your computer screen

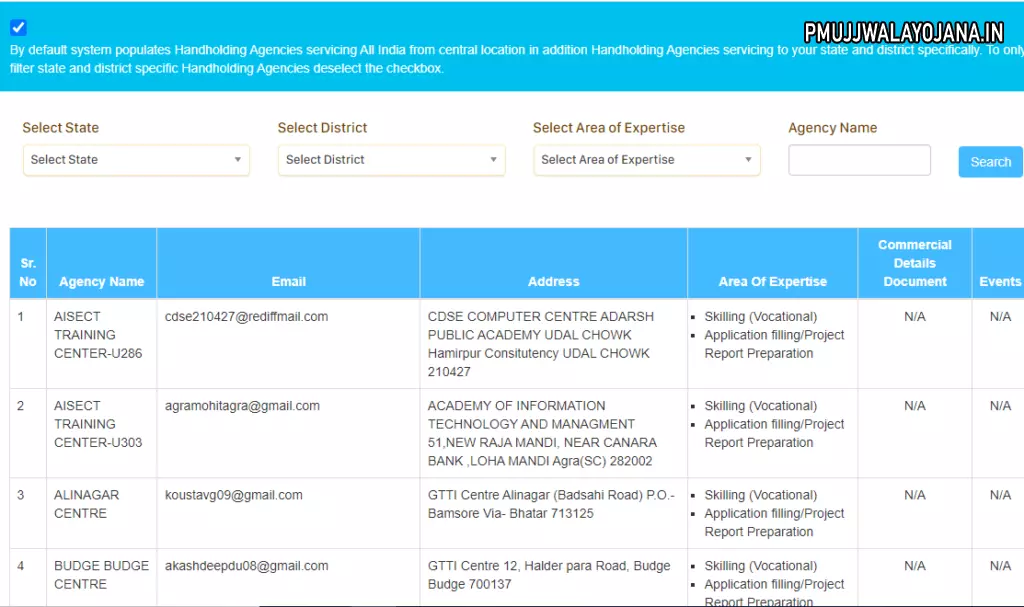

View Details Of Health Centres Across India

- Visit the official website of Stand up India loan scheme

- The home page will open before you

- Now you are required to click on health centres

- A new page will appear before you

- On this new page you have to select state, district, expertise and agency name

- Now you have to click on search

- Required information will appear before

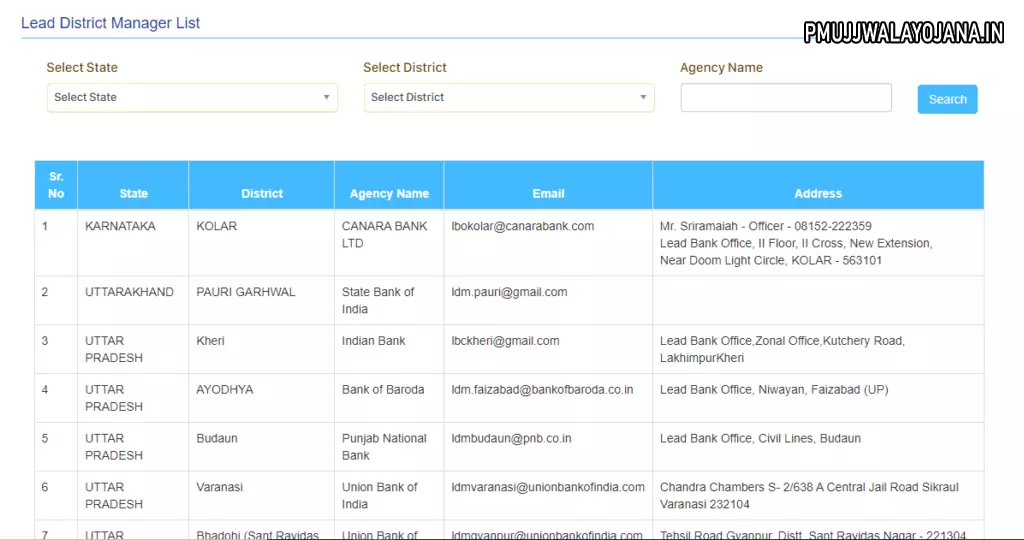

Procedure To View Details About Ldms

- First of all go to the official website of Stand up India loan scheme

- The home page will open before you

- On the homepage you have to click on LDMs option.

- A new page will appear before you

- On this new page you have to select state, district and agency

- Now you have to click on search

- Required information will appear before you

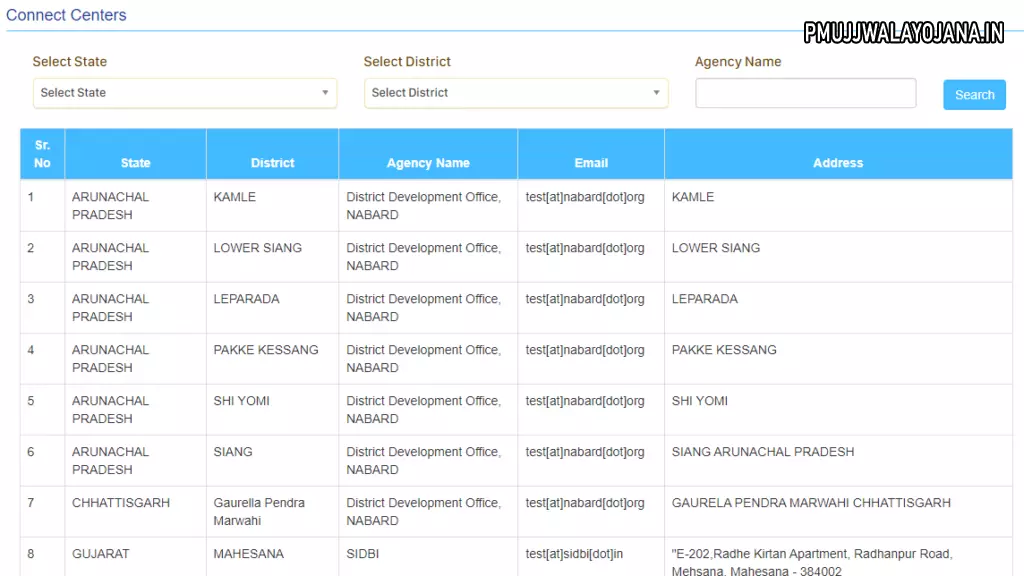

View Details About Connect Centres

- Visit the official website of Stand up India loan scheme

- The home page will open before you

- On the homepage you should click on connect centres

- A new page will appear before you

- On this new page you have to select your state, district and agency name

- Now you have to click on search

- Required information will appear before you

Contact Information

- Email:- support[at]standupmitra[dot]in help[at]standupmitra[dot]in

- National Helpline Toll free Number:-1800-180-1111