Tamil Nadu Guideline Value – Think you might invest in some real estate in Tamil Nadu? Then you need to be familiar with these property-related legal terms. Words like “Tamil Nadu Circular Rates,” “Tamil Nadu Guideline Value” and “Tamil Nadu Market Value” may be familiar to you. These could be difficult to grasp at first. You’ll feel more at ease when conducting business once you’ve established a firm grasp on the distinctions between these. Everyone looking to buy a home in Tamil Nadu ought to be familiar with the process of determining the state’s minimum acceptable price. This article will be about the Tamil Nadu Guideline Value, its objectives, and all the relevant details.

Tamil Nadu Guideline Value 2024

Before talking about the scheme, let’s understand some terms. The estimated market value of a piece of land based on official data is called the “guideline value.” So guidelines = market value. Guideline value is typically less than market value. A property’s value cannot be less than the guideline value for registration purposes. Avoiding stamp duty evasion is the main goal of putting the guideline value into practice. The following elements are taken into account by the government when setting the guideline value: neighborhood development, prior sales at a given survey number or street, etc.

The guideline value of a property has a significant impact on the choice to purchase it and the subsequent registration of that property. The guideline value can be used by the registering officer to spot properties that are undervalued to avoid paying registration fees. The appropriate District Registrar, Inspector General of Registrations, and Deputy Inspector General of Registrations should be informed if the guideline value is excessively higher than the market value so that the disparity can be fixed.

In urban areas, the guideline value for a section of a street or the entire street may be the same. This holds even if the plots/land parcels on the same Street/locality have different survey numbers. The price per square meter or acre is presented as the basis for the recommended value. Cities and towns may use square feet, whereas developed areas may also use square feet. For Agricultural Land and Undeveloped Land, the unit of measure shall be “per acre.”

Tamilnadu Engirundhum Ennerathilum Scheme will Help in Patta Transfer

03rd Jan Update:- New Guidelines value released

On Wednesday, the Tamil Nadu government established the combined worth of properties situated on nearly three lakh roads and streets around the region. The composite value for nearly 1.5 lakh streets and roads in Chennai alone has been released. The highest rate was 28,500 per square foot in the vicinity of the Boat Club. There is a one-time fee of 7% of the total value for registration. For a 1,000-square-foot apartment on St Mary’s Road in Mylapore, the registration fees are now 13 lakh, or 7% of the fixed composite value of 15,000 per square foot. For a flat valued at 50 lakh undivided shares (UDS) and constructed for 1 crore, the registration fees were before 8.5 lakhs. The cost in Muthialpet, North Chennai, from Thambu Street to Mooker Nallamuthu Street, has been set at 16,500 per square foot.

Bazullah Road in T Nagar has the same composite value. Suburban Tambaram has the lowest value, which starts at ₹3,800 and goes up to about ₹6,000. Not every street has been covered because some might not be appropriate for structures with multiple stories. Based on the lowest rate in a basic apartment complex, we calculated the value. There is ₹500 less. While some builders have no issues with the new prices, they do want the stamp value to drop from 7% to 4%. The registration department recently introduced a three-tier guideline value system that will establish a standard guideline value for three categories of apartment complexes based on amenities: basic, premium, and ultra-premium. This system will apply to all neighborhoods. Developers and home buyers objected to the formula because it included greater registration costs, therefore the government reversed it.

Guidelines vs. Real Value

- The government sets guideline values, whereas buyers and sellers decide market values.

- Unlike the market value, guideline value doesn’t alter unless the government decides to revise it.

- Ideal guidelines and market prices should exist.

- India isn’t like this. Market value is usually higher than the guideline value.

- In rare circumstances, inflation, seller motivation, and city proximity all increased market value.

- Property rules are specified for a set time and location.

- The state government estimates and revises the recommended value. Streets determine guiding values in established residential neighborhoods or zones.

- Survey numbers are used to evaluate those properties without clearly defined streets.

Tamil Nadu Guideline Value should be seen before purchasing the land

The significance of knowing a property’s benchmark value lies in the fact that it can be used as a benchmark for future sales.

- Is a major factor in consumers’ final decisions before buying property.

- When it comes to stamps and registration, it’s vital.

- Facilitates timely payment of required registration fees

- No chance of graft and fraud.

- Helps locals learn about property values so they can set fair asking prices when selling their homes

- To put it another way, the Actual value or market value won’t be below the guideline value.

TNREGINET

TNREGINET is an online land record registered in Tamil Nadu. This helps remove the fake document list and reduces duplication. We can access online government records through TNREGINET.

How to Assess Tamil Nadu Property Guideline Value?

Tamil Nadu’s government lets you check property guidelines online for free. People wishing to buy property in Tamil Nadu don’t have to spend extra money on government documents. Two methods determine a property’s guideline value. Two choices:

- Street Name or address

- Survey number

Start by following below steps:

- To begin, you should go to the official websiteof TNREGINET.

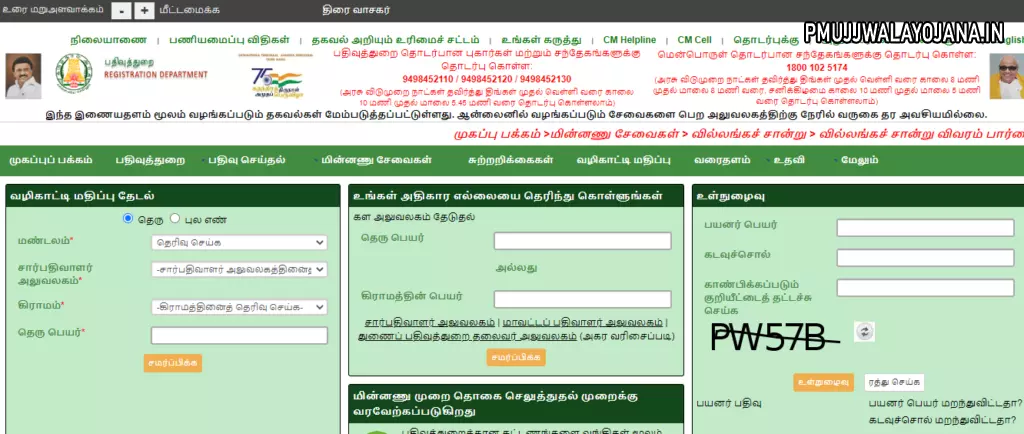

- On the Main Homepage, you should search for a box labeled “Guideline Search.”

- Then a dialogue box appears where you have to enter the survey number, as well as your zone and village.

- After you have submitted the application, you will need to wait for the acre and hectare values to display.

- You also have the option to search on the left side of the page using the street name.

- The street name, the sub-registrar office, the guideline value, and the classification will all be displayed when you do this. Additionally, the guideline value will be displayed.

- In a similar vein, the guideline value can be located by type of any property.

TNREGINET’s Online Portal Registration

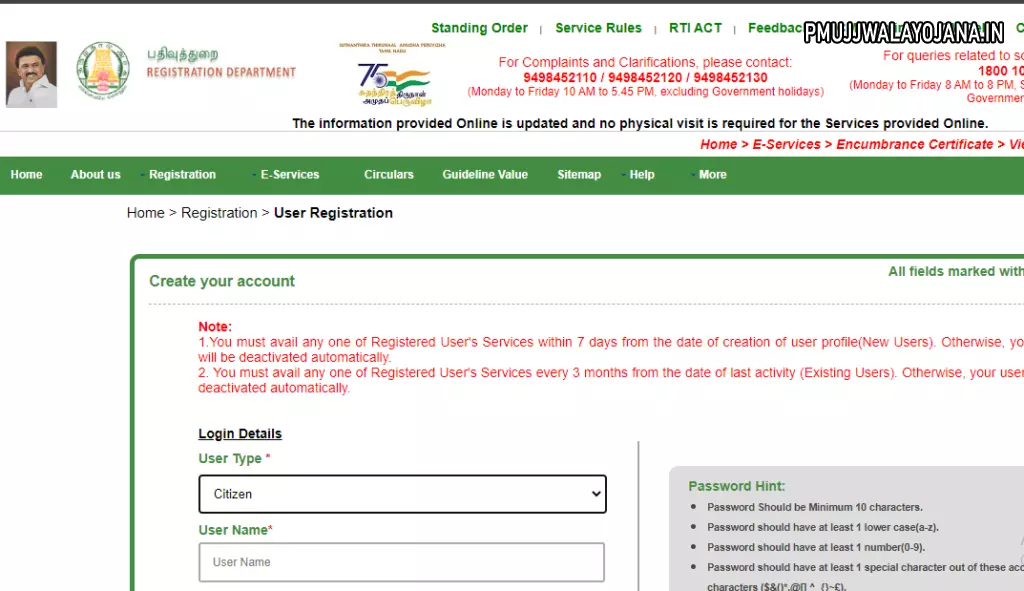

- Go to TNREGINET’s website. A Homepage will appear.

- Select user registration from the menu bar drop-down.

- Based on your demands, choose a citizen, document writer, or lawyer.

- Choose a username and password based on the website’s terms and conditions, then verify the password.

- Fill in personal, contact, and other info. State, District, Postal Code, Address, and mobile number. Enter the security code and OTP, then click “Complete.”

Logging in TNREGINET

The following are the fundamental steps that will serve as your roadmap through the process.

- To access the official website, open up your web browser and enter TNREGINET into the search bar.

- On the homepage, the page to log in can be found in the top right-hand corner.

- In the spaces that are provided, enter not only your username and password but also the code that is displayed on the image.

- When you log in to the website using the button provided, you will be taken to your account. From there, you will be able to access the information that you require.

Tamil Nadu Guideline Value Estimates and Repercussions

The results might be one of two kinds:

- The real estate market’s role in facilitating the movement of illicit funds.

- The State Government’s Loss in Money

- Movement of Illicit Funds

When the property guideline value is less than the market value, there are a number of real estate deals where only the property guideline value is mentioned in the sale contract and all payments are made in cash. The discrepancy between the market value and the guideline value of a property is known as the “making business” of the transaction and is sometimes used to launder illegal funds.

- The State Government’s Loss in Money

The Property Guideline Value is used in determining stamp duty and other property registration fees. If the property guideline value is lower than the market value and is considered the same, it would result in a revenue loss for the various state governments.

Influences on the Worth of Mentorship in Tamil Nadu

According to official statistics from the state, the Guidance value of commercial premises is higher than that of private residences. When setting Guidance value, the government of Tamil Nadu takes into account a variety of variables, including the kind of property, the market worth of the area, and the state of the infrastructure in the area.

For example, in Chennai, the Guidance Value ranges from a low of 40 per square foot to a high of 23,500 per square foot. The highest recommended price per square foot in all of Tamil Nadu may be found in the city of Chennai, where it is set at 23,500.

Tamil Nadu Guideline Value for 2020-21

- Since 2017, there have not been any more edits made to the document.

- After many years of falling real estate transactions, the government of Tamil Nadu has made the decision to lower the guideline values for property registration by a percentage equivalent to 33 percent. After a resolution was reached during a cabinet meeting on June 12, 2020, the revised regulations were put into force the same day.

- In many rural towns, where guideline values have been persistently higher than market values, it is anticipated that this change would lessen the hurdles that prevent property transactions from occurring. The government has raised the registration price for conveyance, exchange, gift, and settlement in favor of non-family members’ deeds from 1% to 4% in order to compensate for the potential loss in income. This increase was made in response to the fact that the charge was previously just 1%.

- Only if the new value is virtually the market value will there be savings. The seller may be entitled for Long Term Capital Gains if the property is sold at the amended guideline value.